Funding Rates in Crypto: The Hidden Cost

.png)

The Essentials - Understanding Funding Rates

Let's begin with a clear analogy.

Picture a bike-sharing system where users rent bikes indefinitely. If everyone wants electric bikes (long positions), the rental fee spikes to discourage overuse. If no one rents cruisers (short positions), the fee drops to entice users. Funding rates operate similarly, acting as a balancing tool in perpetual futures markets.

What Are Perpetual Futures?

Unlike traditional futures contracts, perpetual futures have no expiration date, allowing traders to hold positions indefinitely without rolling over contracts. However, without an expiry, there's no natural mechanism to align futures prices with spot prices.

That's where funding rates step in.

How Funding Rates Function?

In Plain Terms:

- Funding rates are periodic payments exchanged between long and short traders, typically every 8 hours, though some pairs settle as often as every 4 hours.

- Their purpose is to keep the futures price in line with the spot price.

Think of funding rates as a flexible fee that penalizes market imbalances and rewards those betting against the crowd.

Why Funding Rates Are Crucial for Traders

Beginners often overlook funding rates-until they start cutting into profits.

Imagine you're long on ETH with 10x leverage during a period of high positive funding rates. Even if the price stays flat, you're paying shorts every 8 hours. Over time, these fees can erode your gains or even trigger liquidation.

Conversely, if you're short during a bullish frenzy, you collect funding payments just for holding your position.

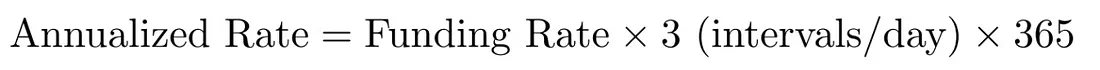

Annualizing Funding Rates: A Long-Term Perspective

To gauge their impact over time, traders calculate the annualized rate:

Example:

If the funding rate is 0.02%:

Annualized = 0.0002 x 3 x 365 = 21.9%

This isn't a fixed cost-rates vary constantly-but it provides a benchmark for comparing with other investment strategies.

How Funding Rates Are Determined

Now that we understand the concept, let's explore:

"What determines the funding rate I pay or receive?"

Let's break it down.

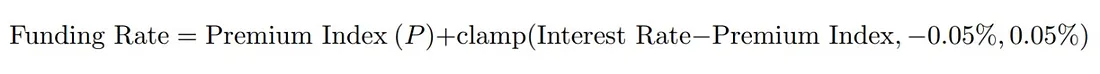

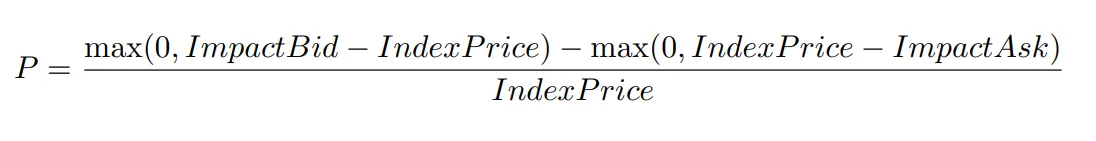

The Calculation:

Here's what each component means:

1. Interest Rate Component:

- Binance uses a fixed 0.01% every 8 hours (0.03% daily).

- This accounts for the difference in returns between holding stablecoins and crypto assets.

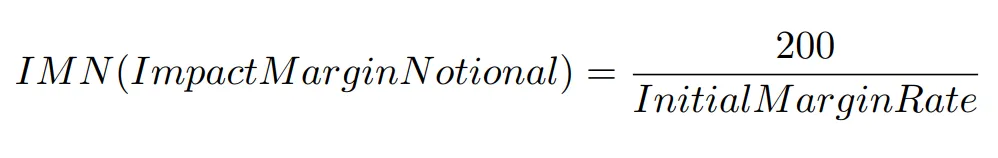

2. Premium Index Component:

This measures the gap between the Mark Price (futures) and Spot Price. Formula:

Impact Bid/Ask Price reflects the cost of executing a standard trade (e.g., $200 worth).

This ensures the rate is based on actual market liquidity, not just order book snapshot

Caps, Floors, and Market Safeguards

To prevent extreme swings during volatile markets, exchanges impose caps and floors on funding rates.

Capped Funding Rate= clamp{Funding Rate, Floor, Cap)

For instance:

- Floor = -0.75 x Maintenance Margin Rate

- Cap = +0.75 x Maintenance Margin Rate

With high leverage, this range might widen to ±2% or ±3%.

Adapting to Market Volatility

Starting May 2025, Binance may adjust funding intervals to every 1 hour when rates hit their caps or floors, enhancing responsiveness during turbulent markets.

This minimizes the risk of persistent imbalances and ensures quicker market adjustments.

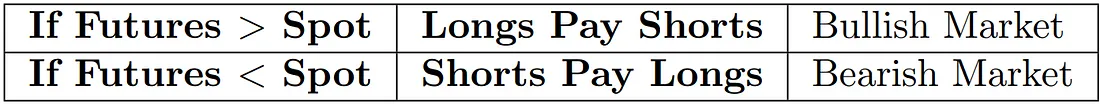

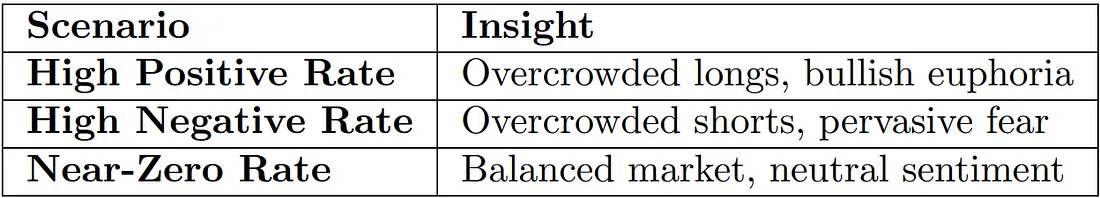

Using Funding Rates to Gauge Market Sentiment

Funding rates are more than just fees-they're a window into market psychology.

Conclusion: Harnessing the Hidden Force

Funding rates may seem like a minor detail, but they quietly shape:

- Profitability in leveraged positions

- Market dynamics

- Strategic decision-making

When planning your next futures trade, don't just focus on "buy or sell." Ask: "Who's footing the bill-and what does it reveal?"

Join Our Team

Explore More Blogs

Yes, You Are on the

Fintech banking advanced technology to offer agile, user friendly & services to traditional banking.

.png)

.png)

.png)

.png)